A plummeting credit score is never good news. It forestalls your ability to qualify for lower interest rates and better loan terms. Improving your credit score is easier than you think. Initiating a credit repair process is the best way to fix your credit score.

Through credit repair, you can correct the errors and accounting mistakes accumulated over a period of time. Every error removal and successful dispute resolution in your favor would raise your credit score. If your credit score has suffered due to poor financial choices or as a consequence of unavoidable liabilities due to the COVID-19 situation, it’s the right time to rebuild your credit score through credit repair. Learn more about credit repair here.

Why is credit repair important?

Through the Credit repair process, you can dispute mistakes and correct errors on your credit reports. The three major credit bureaus are Equifax, TransUnion, and Experian. All creditors and lenders check your credit score via the proprietary version of your credit report from these credit bureaus. You need to make sure that your credit profile has accurate information and is errors free. The Fair Credit Reporting Act (FCRA) gives you the golden opportunity to dispute and correct negative items on your credit report. You can disagree with any false information that appears on your credit report. If the information is inaccurate and cannot be verified within 30-45 days, the credit bureau would remove the negative item you disputed.

Some of the common errors in the credit report include disputes with a repayment plan, incorrect account statuses, outdated information, identity theft, and wrong re-aging or purge-from date.

The time required and the level of boost in your credit score will depend upon your current budget and the number of negative items in your credit report you wish to dispute. The higher number of dispute resolutions would obviously provide a significant boost to your credit score.

How to repair credit score?

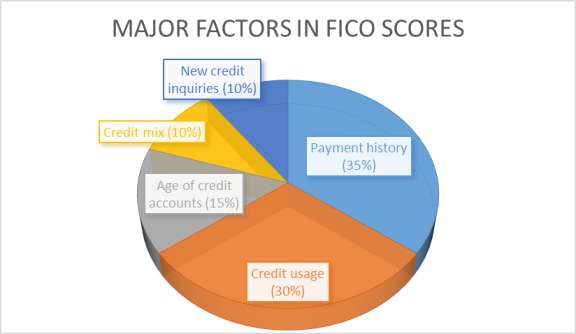

FICO (Fair Isaac Corporation) credit scores are used by the majority of lenders. FICO credit scores are determined by payment history (35%), credit usage (30%), age of credit accounts (15%), credit mix (10%), and new credit inquiries (10%).

Check your credit report

You can get a free copy of your credit report at AnnualCreditReport.com. Once you know your credit score, you can make an informed decision on the next course of action. Review your credit report thoroughly for the entries that are hurting your credit score. Cross-check for the payments you made on time but aren’t reflected in the credit report, purchases that you didn’t make, outdated information, and old negative entries that are more than seven years older that should have been removed by now. Immediately dispute and get the errors removed through a credit reporting company. You can find templates of credit dispute letters and more information at the CFPB site.

Limit new credit inquiries

Avoid requesting new credit lines. Frequent ‘Hard’ Inquiries for new credit card applications, personal loan, or any other loans can negatively affect your credit scores. New credit inquiries are a sign of financial difficulties that raise red flags for lenders.

Create positive payment history

In the long run, managing your finances smartly and making payments on time keeps your credit score strong. Payment history and credit utilization rate are the most significant factors that affect credit score. Pay off your credit card and loan amounts as quickly as possible to keep your credit utilization ratio at a minimum under 30%.

Maintain a good credit utilization ratio

Lenders prefer credit utilization between 30% to 10%. For example, if you have a total of $10000 credit available from all accounts and your credit debt is $5,000, your credit utilization is 50%. You need to pay off $2000 or more to bring it down to 30%. A credit repair company or credit counselor can help you plan your budget, give tips on finance management, and develop a debt management plan after reviewing your credit report.

Debt consolidation strategy

Debt consolidation allows you to raise your credit score. You can apply for a debt consolidation loan to pay all your outstanding debts with one single balance transfer. The positive aspect of debt consolidation is that you could get a lower interest rate and only have one loan payment to take care of, which would help you clear your debt quickly. Additionally, it would decrease your credit utilization ratio, which could significantly increase your credit score.

An individual’s financial health is measured by credit score. The best way to achieve a high credit score is to start taking steps to fix your credit situation sooner than later. Take advantage of the time to build a positive payment history and pay attention to any errors in the credit report.

Hunaid Germanwala is a digital marketer and content creator at Health Products For You since 2014. He has an MS from Ulm University in Germany. His mind is always buzzing with creative ideas and is eager to explore new perspectives. His motto in life is “Better to Light the Candle than to Curse the Darkness.”

Leave a Reply