If you’re reading this, you’re probably looking to save money on your mortgage, clarify your doubts about purchasing or refinancing a house, or find an easy way to plan your monthly mortgage payments. After all, who wouldn’t like to be mentally serene when it comes to money matters? It is essential to estimate monthly mortgage payments and additional expenses when you decide to buy a new home. It is always better to plan ahead. Online Mortgage calculators are a great help for people who want to save money, plan their future finances, and have a better home.

What is a Mortgage and how does it work?

Put simply, a Mortgage is like giving the ownership of your property to someone else who is lending you the money against it for a specific amount of time. Depending on what you and your lender have agreed upon, that time can be 15 years, 20 years, or 30 years. In that duration, let’s say 30 years, you’ll have to pay an installment every month along with the interest rate to pay off the amount loaned.

If you are a first-time home buyer, select the right mortgage based on down payments, loan terms and eligibility requirements. The shorter the duration of the Mortgage higher the principal amount you’ll have to pay monthly but the lower will be the interest rate. On the other hand, the longer the duration of the mortgage lesser the principal amount you’ll have to pay monthly but the higher will be the interest rate.

How Online Mortgage Calculators can help?

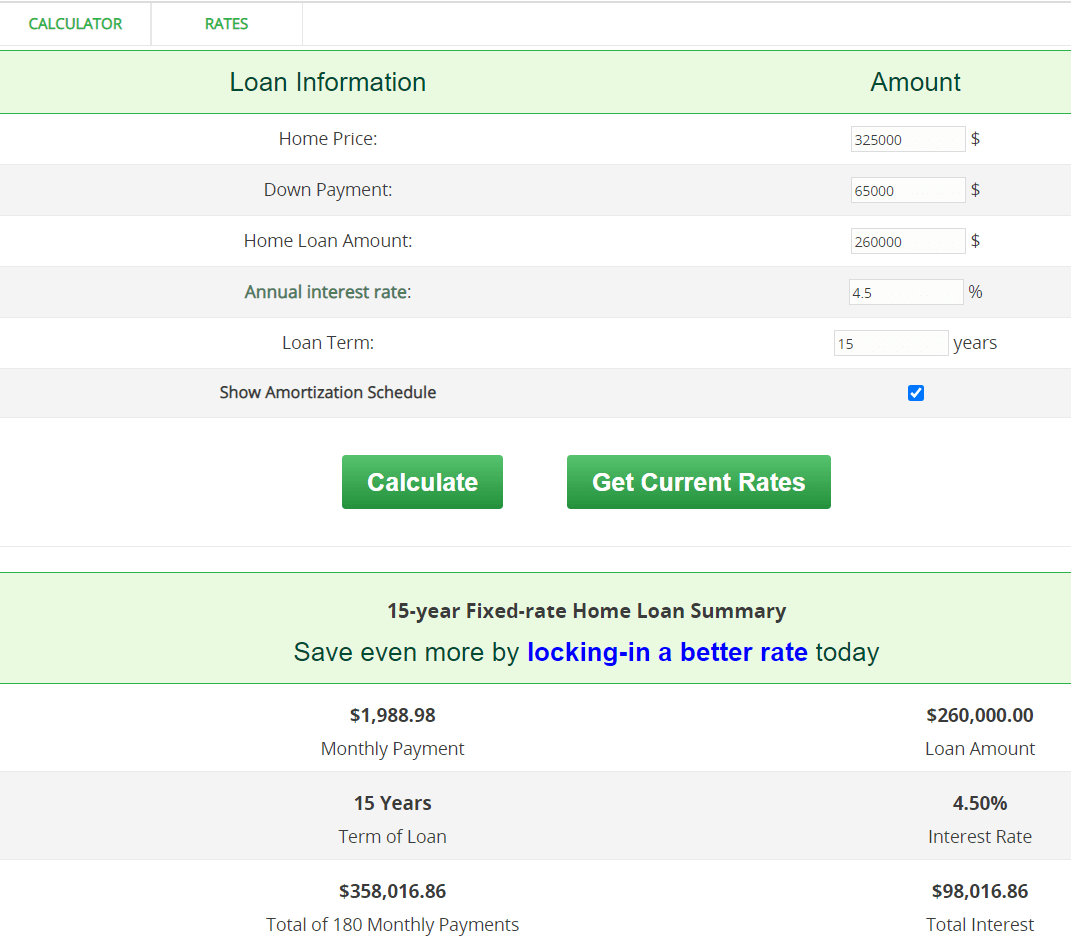

You can use online mortgage calculators at any time and place to help you estimate your monthly mortgage payment. While you are on a house-hunting spree or surveying your potential neighborhood, you can fill in basic information into the mortgage calculator, such as the home’s purchase price, down payment, loan term, and interest rate. It will provide you with an accurate estimation of your monthly mortgage payments and other financial costs and gains of homebuying.

How to use mortgage calculator?

You can use the simple Monthly Mortgage Payment Amount Calculator available at https://www.mortgagecalculators.info/.

Home price: If you are looking for an affordable home, enter the home price based on your budget. The mortgage calculator will get you the estimate of monthly payments to help you plan your budget for a home that you can afford.

Down payment: Mortgage calculators come in handy when you want to understand the impact of down payments on your monthly mortgage payments. Input your down payment numbers based on your current finances and future expenses such as new furniture, structural upkeep, emergency funds, maintenance equipment, taxes, insurance, and other miscellaneous fees. You can use advanced mortgage calculator for accurate estimation. If you put very little down payment (less than 20%), you will have to pay larger monthly mortgage payments and pay private mortgage insurance (PMI). Adjust the numbers in the mortgage calculator to know the best down payment amount for you to ease the financial strain.

Home Loan Amount: Enter your home loan amount based on the maximum loan you can qualify based on your current income and debt payments (debt to income ratio, DTI). Use the free calculator to find out how big of a loan you can qualify for based on DTI limits for all major loan types. Mortgage affordability calculator can give you more insights into how much you can afford on a home based on your income and debt payments.

Annual Interest Rate: Enter the interest rate for the home loan. Here you can estimate your monthly mortgage payments according to the base rate. The lower base interest rate is used because your monthly payment doesn’t consider any other fees or closing costs. Know your APR (Annual percentage rate) to understand the overall cost of the loan instead of monthly expenses. Use Real Annual Percentage Rate Calculator to see the actual APR for loans with different point totals or other closing costs by merging these other expenses into the effective interest rate.

Loan Term: Enter the number of years in which you plan to repay the loan. For conventional loans, 15 and 30-year terms are typical. Loan terms stretched over many years result in smaller affordable payments, but money paid on interest increases. Shorter loan terms have considerably larger payments but save money on interest payments. An online mortgage calculator can help you decide the best loan term. You need to be honest while selecting your loan term. Consider opting for the lesser amount and more prolonged duration if you are uncertain about your future financial status. You can use loan term comparison calculator to compare your monthly payments and total interest expense on 15 years and 30 years home loan.

Keeping track of the amount paid monthly or figuring out the amount you’re comfortable paying each month can be tedious and hectic. Recording in a diary, calculating all the time, and thinking about it can be full of stress and hassle. The modern and technological era we’re living in gives us the advantage of delegating or easing tasks. You can search on the internet at the comfort of your home and let online calculate mortgage make financial decision-making easier for you. The best part is that they are reliable and accurate.

The online mortgage calculators can give you various features like a Monthly payment calculator, minimum income requirement, home loan limit, DTI, etc. They can show you graphical representations, savings made, balance graph, loan summaries, and much more.

What are different Types of Mortgages?

Mortgages can be of many types. The most common yet popular is a 15-year fixed and 30 years fixed. Some can be as short as 5 years, and some can stretch to 35-40 years.

The two most common types of Mortgage that people go with are:

- Fixed-rate mortgage

- Adjustable-rate Mortgage

- Interest-only loans

Fixed-rate mortgage

The fixed-rate mortgage is the kind of mortgage where the principal amount and interest levied remain the same for the mortgage loan duration. So, let’s say, if you have mortgaged property for 30 years, you’ll have to pay the same principal amount, and the interest levied till wholly paid off. People are inclined to choose this kind as they can plan their monthly expenditure. There is no uncertainty.

Adjustable-rate Mortgage

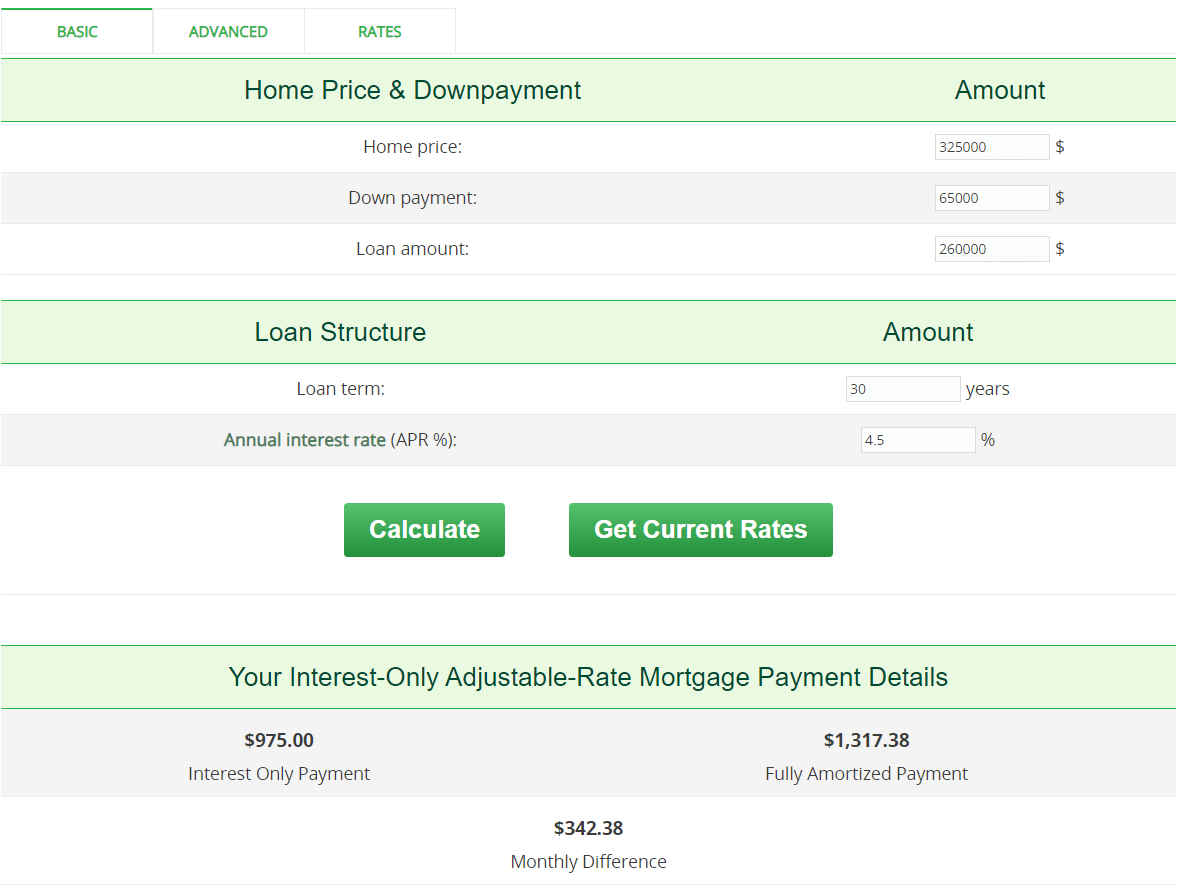

On the other hand, under an adjustable-rate Mortgage, the interest levied on the principal amount changes after the initial term. The change will be dependent on the market rate. So, let’s say if you opt for an Adjustable-rate mortgage, for the initial term, you’ll get the advantage of paying interest lesser than the market, but after that, it may shoot higher than the expectation, which can make it harder to pay monthly or it can be low as well giving you the advantage. It is uncertain about judging the upcoming interest rate. ARM is considered a good option if you plan to stay in your home for only a few years. Use ARM calculator to estimate. the monthly principal & interest payments on an adjustable-rate mortgage.

Interest-Only Loans

Interest only loans provide the flexibility to borrower to pay only interest for the first few years while the principal amount levied remains unchanged. Interest only loans are attractive to first-time homeowners because of the low payments during initial years when they are unsure of their finances. It is also a popular choice for people who want to own the home for a relatively short period of time and intend to sell the home before the more significant monthly payments begin. If you are considering interest-only home loan, estimate your monthly loan payments for IO and amortizing payments side-by-side using Interest-only Mortgage Calculator.

Types of Mortgage Calculators

Since you’ll be getting verities of online mortgage calculators, we’ll provide you a brief detail to use the right one.

Purchase Calculator

Using a purchase calculator allows you to get two things done. The first is to fill the down payment amount to calculate the monthly installment easily. The second is to figure out how much monthly installment you can easily manage to pay without delaying or skipping it. A rent or buy calculator can help you choose a better option if you are unsure whether to rent or buy a home.

Refinance Calculator

If your idea is to refinance your current home instead of moving to a new place, there is a calculator for it. You can fill in the details to know about your current goals, like paying off your Mortgage faster or lowering existing loan payments. Knowing how much you owe to the lender can help you stay on track. Use Refinance calculator to calculate your savings.

Amortization Calculator

Amortization Calculator helps you determine the amount paid to the lender every month. It’ll show you two different data, i.e., the principal amount and the interest paid. So, if you can spend more in some months, you can certainly add that amount, which will be added to the principal installment of each month. Doing so will help you pay your mortgage faster and save the money paid as interest.

Online mortgage calculators have an added benefit if you don’t want to share your financial status with an individual. You can make an informed decision based on your financial situation. Play around with numbers to get the best down payment size and savings. Narrow down your home price range when you’re ready to go house hunting.

Once you’ve zeroed down on your home, use the online mortgage calculator to determine the best home loan offers and term to match your budget and future mortgage payments before closing day. Mortgage calculators can make this process easier from early on to run affordability scenarios.

Leave a Reply